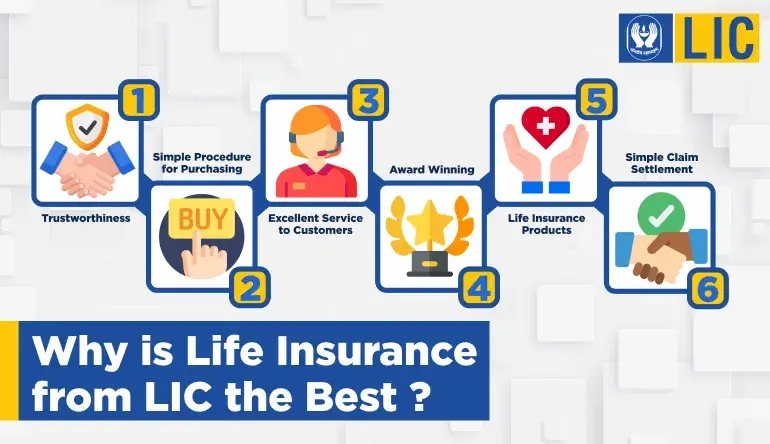

Buy New LIC Policy online

Want to buy Life Insurance from LIC of India without the trouble of contacting agents or visiting the offices of LIC? We have the solution for you. You can now buy LIC policies online Buy LIC Policy Online and the popular LIC plans from the comfort of your home and pay online using Credit card, Debit card, or UPI wallet payments. We are happy to answer your questions on 'How to buy LIC policy online'.LIC Online Policy Purchase Explaining the benefits of LIC online policy Benefits of Buying LIC Policy Online purchase, Where we can guide you on how to choose the best LIC policy using this website.